-

As rents rise, so do pressures on people at risk of eviction

By Sophie Kasakove | The New York Times The heightened strain on available housing has strengthened the position of landlords. “Landlords seem anxious to move tenants out so they can go out and take advantage of those higher rents,” said Zach Neumann, director of the COVID-19 Eviction Defense Project in Colorado. Skyrocketing rents are blunting…

-

As rents in South Florida soar out of reach, more people are finding themselves priced out — and onto the streets

By Amber Randall | South Florida Sun Sentinel It’s been two weeks since Sean Jeremy’s landlord raised his rent beyond what he could afford. For now, the only place he can afford to live is in his car. Soaring rents in South Florida are putting others like Jeremy is a similar bind. With housing costs…

-

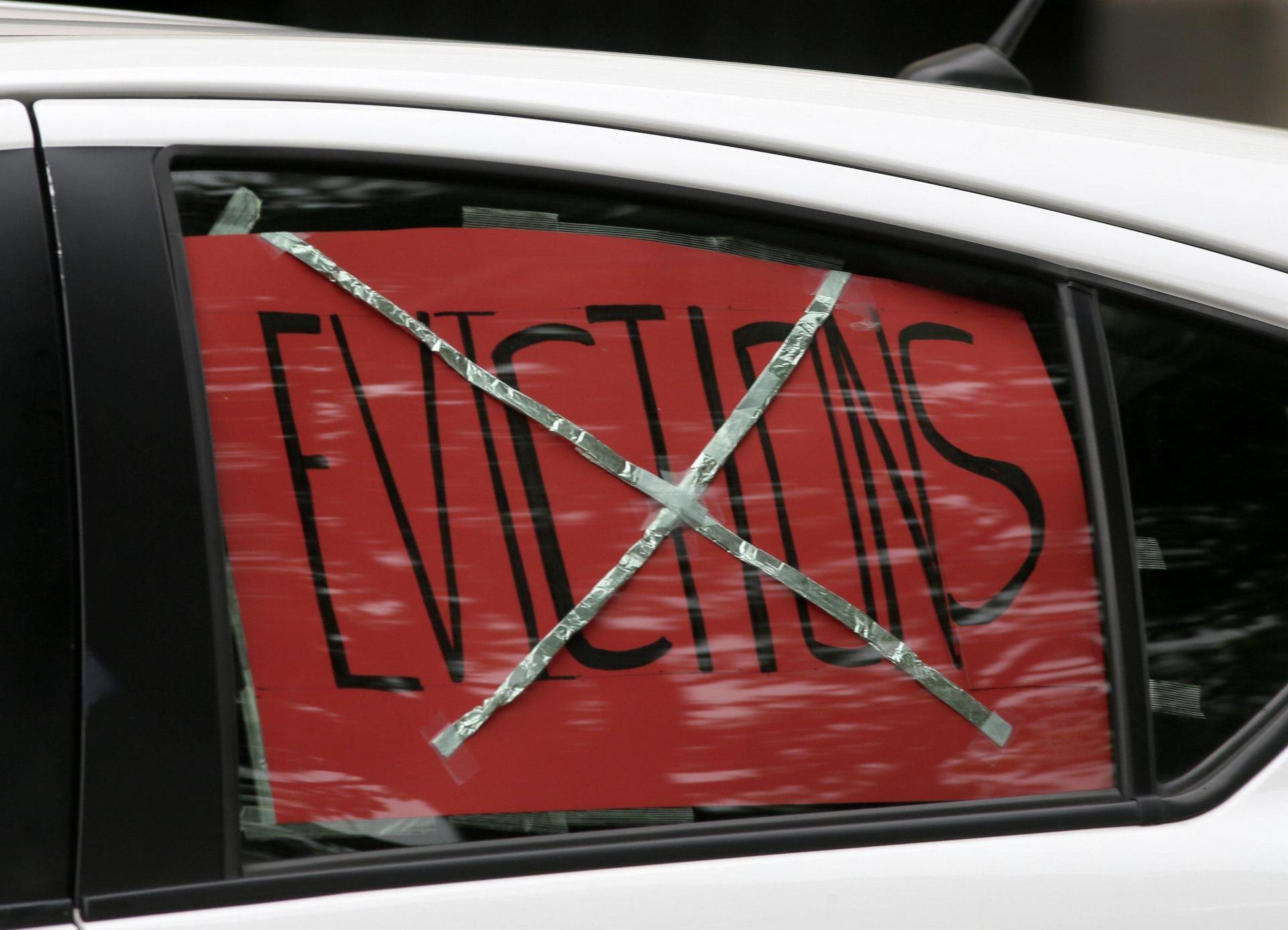

The CDC Extends Its Eviction Moratorium For 30 Days

For inquiries, please reach out to Today in Housing Managing Editor Ahmad Abu-Khalaf, senior research analyst at Enterprise. JUNE 24, 2021 Today, CDC Director Dr. Rochelle Walensky extended the agency’s temporary eviction moratorium for qualifying renters, which was set to expire on June 30, 2021, through July 31, 2021. A press release from the CDC…

-

The FHA Foreclosure Moratorium Ends of June 30, 2021

Covid-19 has impacted the world and nation in ways that we could not have imagined. We understand the hardships faced as you are struggling to pay your mortgage. The FHA foreclosure moratorium that began in March last year comes to an end on June 30, 2021. While the economy enters recovery phase, many families are…

-

Locked Out: Low pay, soaring rents, pro-landlord laws set up Florida renters for eviction once COVID hit

By Caroline Glenn | May 13, 2021 | A Three-Part Orlando Sentinel Special Report How COVID exposed Florida’s eviction crisis Jocelyn Bennett paints her daughters’ toenails, not bothered by the strong scent of nail polish filling the room at the HomeTown Studios in Orlando. The girls show off their pink toes, toddling around the small…

-

If ‘Housing Is a Right,’ How Do We Make It Happen?

By Eva Rosen | The New York Times | Feb. 17, 2021 Dr. Rosen has been conducting in-person research on the housing market in poor neighborhoods in Baltimore for more than 10 years. Her book, “The Voucher Promise: ‘Section 8’ and the Fate of an American Neighborhood,” tells that story. “Housing is a right in…