-

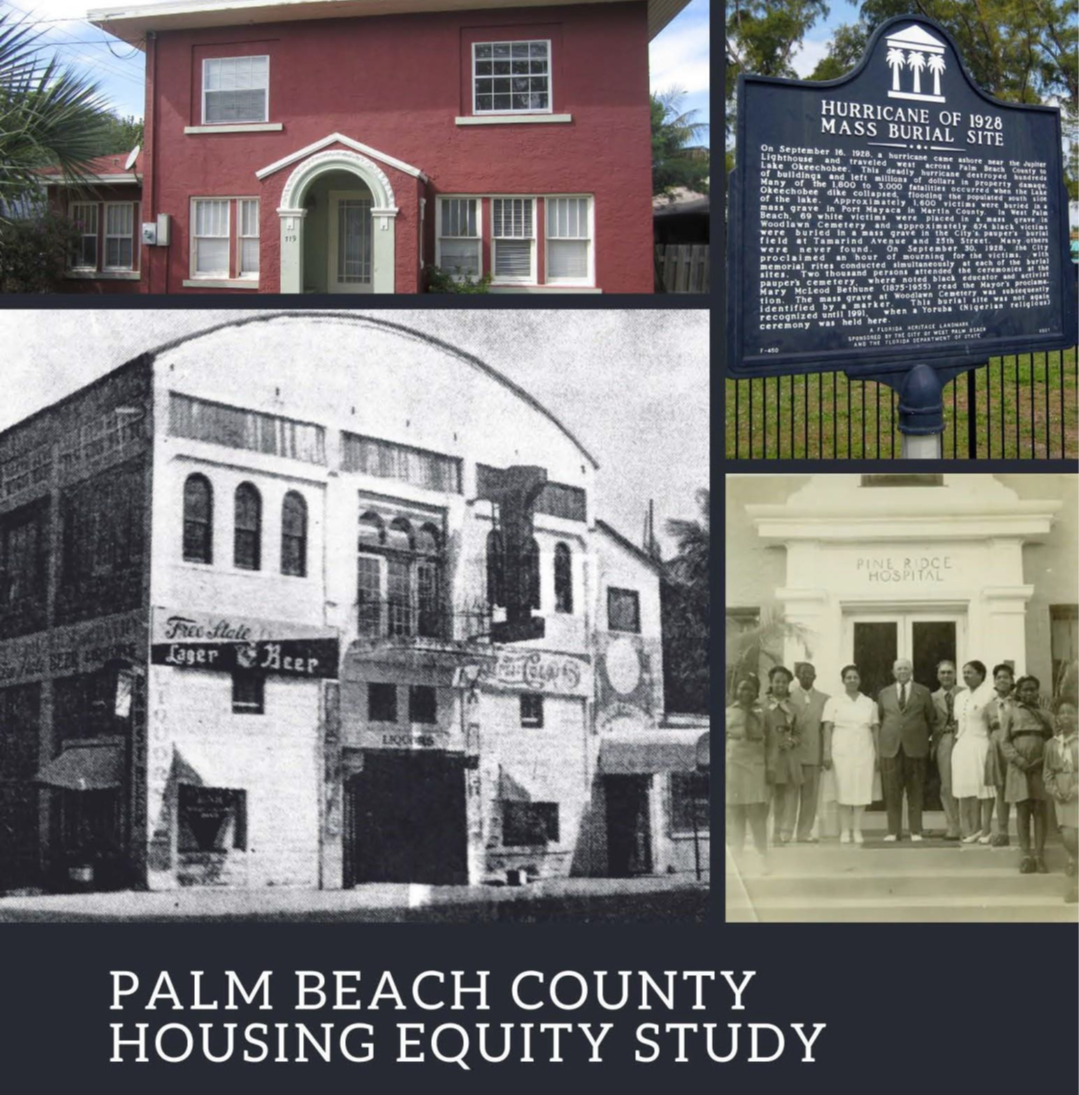

$200 million, 20,000 affordable housing units: New study helps ID areas in need

By ABIGAIL HASEBROOCK | ahasebroock@sunsentinel.com | South Florida Sun Sentinel PUBLISHED: November 2, 2023 The Housing Leadership Council of Palm Beach County, a coalition working to sustain economic viability through housing opportunities, is forging ahead […]

-

Here’s how much money you need to afford the average rent in South Florida

By Amber Bonefont | South Florida Sun Sentinel Renters in South Florida need to make over $100,000 in order to rent comfortably in the tri-county area, according to a new […]

-

Florida rent increases top of the nation with no quick fix in sight

By: Kimberly Miller | Palm Beach Post Crushing rent increases put eight Florida regions, including Palm Beach County, into the top 10 nationwide for priciest hikes since last year, leaving […]

-

Priced Out of Paradise: What are the solutions to Florida’s housing crisis?

By Dave Bohman | WPTV West Palm Beach Group to urge Palm Beach County to raise $200M in bonds for affordable housing READ ARTICLE

-

Florida’s affordable housing problem has no quick solution

By: Andrew Atkins, USA Today Network – Florida As Florida’s population grows, so does its affordable housing problem. For local communities around the state, there’s no quick answer. WATCH VIDEO

-

‘There’s no more room in Florida’ says mom who blames high prices on newcomers.

By: Kimberly Miller | Palm Beach Post Young adults and low-wage workers aren’t the only ones suffering from soaring rents as middle-age and middle-income Floridians also face downsizing homes and […]